LIC Jeevan Akshay - VII (Plan No. 857)

A Non-Linked, Non-Participating, Individual Immediate Annuity Plan

Introduction-

- This is an Immediate Annuity plan wherein the Policyholder has an option to choose type of annuity from 10 available options on payment of a lump sum amount.

- The annuity rates are guaranteed at the inception of the policy and annuities are payable throughout the lifetime of Annuitant(s).

Annuity Options-

The available annuity options under this plan are as under-

- Option A: Immediate Annuity for life.

- Option B: Immediate Annuity with guaranteed period of 5 years and life thereafter.

- Option C: Immediate Annuity with guaranteed period of 10 years and life thereafter.

- Option D: Immediate Annuity with guaranteed period of 15 years and life thereafter.

- Option E: Immediate Annuity with guaranteed period of 20 years and life thereafter.

- Option F: Immediate Annuity for life with return of Purchase Price.

- Option G: Immediate Annuity for life increasing at a simple rate of 3% p.a.

- Option H: Joint Life Immediate Annuity for life with a provision for 50% of the annuity to the Secondary Annuitant on death of the Primary Annuitant.

- Option I: Joint Life Immediate Annuity for life with a provision for 100% of the annuity payable as long as one of the Annuitant survives.

- Option J: Joint Life Immediate Annuity for life with a provision for 100% of the annuity payable as long as one of the Annuitant survives and return of Purchase Price on death of last survivor.

Annuity option once chosen cannot be altered.

Benefits

Benefits payable under above options are

Option A-

- The annuity payments shall be made in arrears for as long as the Annuitant is alive, as per the chosen mode of annuity payment.

- On death of Annuitant, nothing shall be payable and the annuity payment shall cease immediately.

Option B,C,D,E -

- The annuity payments shall be made in arrears for as long as the Annuitant is alive, as per the chosen mode of annuity payment.

- On death of the Annuitant during the guaranteed period of 5/10/15/20 years, the annuity shall be payable to the nominee(s) till the end of the guaranteed period.

- On death of the Annuitant after the guaranteed period, nothing shall be payable and the annuity payment shall cease immediately.

Option F-

- The annuity payments shall be made in arrears for as long as the Annuitant is alive, as per the chosen mode of annuity payment.

- On death of the annuitant, the annuity payment shall cease immediately and Purchase Price shall be payable to nominee(s) as per the option exercised by the Annuitant.

Option G-

- The annuity payments shall be made in arrears for as long as the Annuitant is alive, as per the chosen mode of annuity payment. The annuity payment will be increased by a simple rate of 3% per annum for each completed policy year.

- On death of annuitant nothing shall be payable and the annuity payment shall cease immediately.

Option H-

- The annuity payments shall be made in arrears for as long as the Primary Annuitant is alive, as per the chosen mode of annuity payment.

- On death of Primary Annuitant, 50% of the annuity amount shall be payable to the surviving Secondary Annuitant as long as the Secondary Annuitant is alive. The annuity payments will cease on the subsequent death of the Secondary Annuitant.

- If the Secondary Annuitant predeceases the Primary Annuitant, the annuity payments shall continue to be paid and will cease upon the death of the Primary Annuitant.

Option I-

- 100% of the annuity amount shall be paid in arrears for as long as the Primary Annuitant and/or Secondary Annuitant is alive, as per the chosen mode of annuity payment.

- On death of the last survivor, the annuity payments will cease immediately and nothing shall be payable.

Option J-

- 100% of the annuity amount shall be paid in arrears for as long as the Primary Annuitant and/or Secondary Annuitant is alive, as per the chosen mode of annuity payment.

- On death of the last survivor, the annuity payments will cease immediately and Purchase Price shall be payable to the nominee(s) as per the option exercised by the Primary Annuitant.

Eligibility Criteria-

(i)- Minimum Purchase Price - ₹1,00,000/- subject to Minimum Annuity as specified below.

Note: The above mentioned minimum purchase price would be increased appropriately to meet minimum annuity criterion as specified below.

For Purchase Price less than ₹1,50,000/-, annuity rates given under this plan shall be reduced with Reduction Factors as given in Para 7 below.

(ii)- Maximum Purchase Price - No Limit

(iii)- Minimum Age at Entry - 30 years (completed)

(iv)- Maximum Age at Entry - 85 years (completed) except Option F / 100 years (completed) for Option F

(v)- Minimum Annuity -

Joint Life: The joint life annuity can be taken between any two lineal descendant/ascendant of a family (i.e. Grandparent, Parent, Children, Grandchildren) or spouse or siblings. yearly plus 300 basis points. The 10 year G-Sec rate shall be as at last trading date of previous financial year. The calculated interest rate shall be applicable for full term of Loan.

For the loan sanctioned during the 12 months period commencing from 1st May, 2020 to 30th April, 2021, the applicable interest rate is 9.50% p.a. effective for entire term of the loan.

Any change in basis of determination of interest rate for policy loan shall be subject to prior approval of IRDAI.

Options-

Options available for payment of Death Benefit-

Under the annuity options where the benefit is payable on death i.e. Option F and Option J, the Annuitant(s) will have to choose one of the following options for the payment of the death benefit to the nominee(s).The death claim amount shall then be paid to the nominee(s) as per the option exercised by the Annuitant(s) and no alteration whatsoever shall be allowed to be made by the nominee(s).

Lumpsum Death Benefit- Under this option the entire Purchase Price shall be payable to the nominee(s) in lumpsum.

Annuitization of Death Benefit- Under this option the benefit amount payable on death i.e. Purchase Price shall be utilized for purchasing an Immediate Annuity from the Corporation for nominee(s). The annuity amount payable to the nominee(s) on the admission of death claim shall be based on the age of nominee(s) and immediate annuity rates prevailing as on the date of death of Annuitant (last survivor in case of Joint Life Annuity). This option can be opted for full or part of the benefit amount payable on death. However, the annuity payments for each nominee(s) shall be subject to the eligibility conditions of the annuity plan available at that time and then prevailing Regulatory provisions on the minimum limits for annuities.

In Instalment- Under this option the benefit amount payable on death i.e. Purchase Price can be received in instalments over the chosen period of 5 or 10 or 15 years instead of lumpsum amount. This option can be exercised for full or part of the Death Benefit payable under the policy. The amount opted by the Annuitant(s) (i.e. net claim amount) can be either in absolute value or as a percentage of the total claim proceeds payable.

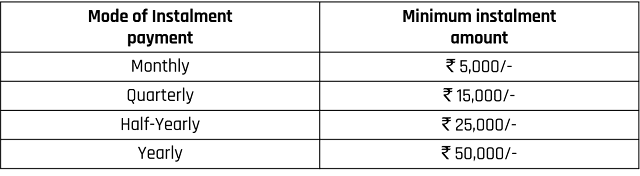

The instalments shall be paid in advance at yearly or half-yearly or quarterly or monthly intervals, as opted for, subject to minimum instalment amount for different modes of payments being as under:

If the Net Claim Amount is less than the required amount to provide the minimum installment amount as per the option exercised by the Annuitant(s), the claim proceed shall be paid in lumpsum only.

For all the instalment payment options commencing during the 12 months’ period from 1st May to 30th April, the interest rate applicable for arriving at the instalment amount shall be annual effective rate equal to the 10 year G-Sec rate p.a. compounding half-yearly minus 200 basis points; where, the 10 year G-Sec rate shall be as at last trading day of previous financial year.

Accordingly, for the 12 months’ period commencing from 1st May, 2020 to 30th April, 2021, the applicable interest rate for the calculation of instalment amount shall be 4.71% p.a. effective.

For example, if this option has been exercised for the Net Claim Amount of ₹10,00,000/-, the amount of each instalment payable in advance for instalment payment options commencing during the 12 months’ period beginning from 1st May, 2020 to 30th April, 2021, shall be as below:

Option to take Annuity by NPS subscriber-

The annuity options as allowed as per PFRDA Regulations shall be available to NPS subscribers.

If a Government Sector NPS subscriber purchases this plan as a Default Option, then Option J shall be available to the subscriber whose spouse is surviving on the date of purchase. Option F shall be available to the subscriber in the absence of his or her spouse. Thereafter on the death of subscriber and his or her spouse, the purchase price shall be used to purchase annuity Option F or J on the life of living dependant mother/father and shall be subject to the eligibility conditions of the annuity plan available at that time.

Subject to the specific Plan features, all other terms and condition including the Default Option applicable shall be as per the Rules, Regulations, Guidelines, and Circulars etc. issued by Pension Fund Regulatory and Development Authority (PFRDA) from time to time in this regard.

Option to take the plan for the benefit of dependent person with disability (Divyangjan)-

If the Proposer has a dependant person with disability (Divyangjan) , the plan can be purchased for the benefit of Divyangjan as Nominee/Secondary Annuitant, subject to minimum Purchase Price of ₹50,000/- without any limit on minimum annuity payment and minimum age at entry (for Divyangjan life), in following ways;

- The Proposer can purchase Immediate Annuity with Return of Purchase Price (Option F) on own life. In case of death of the Annuitant (Proposer), the Death Benefit shall compulsorily be utilized to purchase Immediate Annuity (as per option chosen by the Annuitant) on the life of the Divyangjan.

- The Proposer can purchase Joint Life Annuity (Option I or J) with Divyangjan as Secondary Annuitant.

Loan-

Loan facility shall be available at any time after three months from the completion of policy (i.e. 3 months from the date of issuance of policy) or after expiry of the free-look period, whichever is later, subject to terms and conditions as the Corporation may specify from time to time.

As per current provisions, policy loan shall be allowed under the following annuity options only

Option F: Immediate Annuity for life with return of Purchase Price.

Option J: Joint Life Immediate Annuity for life with a provision for 100% of the annuity payable as long as one of the Annuitant survives and return of Purchase Price on death of last survivor.

The maximum amount of loan that can be granted under the policy shall be such that the effective annual interest amount payable on loan does not exceed 50% of the annual annuity amount and shall be subject to maximum of 80% of Surrender Value. Loan interest will be recovered from annuity amount payable under the policy. The loan outstanding shall be recovered from the claim proceeds at the time of exit.

The loan interest rate for all the loans commencing during the 12 months’ period from 1st May to 30th April, shall be annual effective rate not exceeding 10 year G-Sec rate p.a. compounding half yearly plus 300 basis points. The 10 year G-Sec rate shall be as at last trading date of previous financial year. The calculated interest rate shall be applicable for full term of Loan.

For the loan sanctioned during the 12 months’ period commencing from 1st May, 2020 to 30th April, 2021, the applicable interest rate is 9.50% p.a. effective for entire term of the loan.

Any change in basis of determination of interest rate for policy loan shall be subject to prior approval of IRDAI.

| Details | Links |

|---|---|

| My YouTube- | Click Here |

| My Facebook- | Click Here |

| My Twitter- | Click Here |

| My Linkedin- | Click Here |

| My Instagram- | Click Here |

| My Digital Business Card- | Click Here |

| My Locator Page- | Click Here |

| All India LIC Office List- | Click Here |

Note-

If you have bought LIC policy or are thinking to buy any policy in future. Then you should click on the link given below. This link is a link to a survey form.

Some videos have also been added with this form. In which important information has been given regarding your LIC policy (which you have already purchased). To avoid future problems, you must watch the video and you can give us your suggestions and feedback by filling the form.

We will try to convey the information given by you to the corporation and if you feel the need of any kind of cooperation. Then, we will try to manage for this.

No comments:

Post a Comment